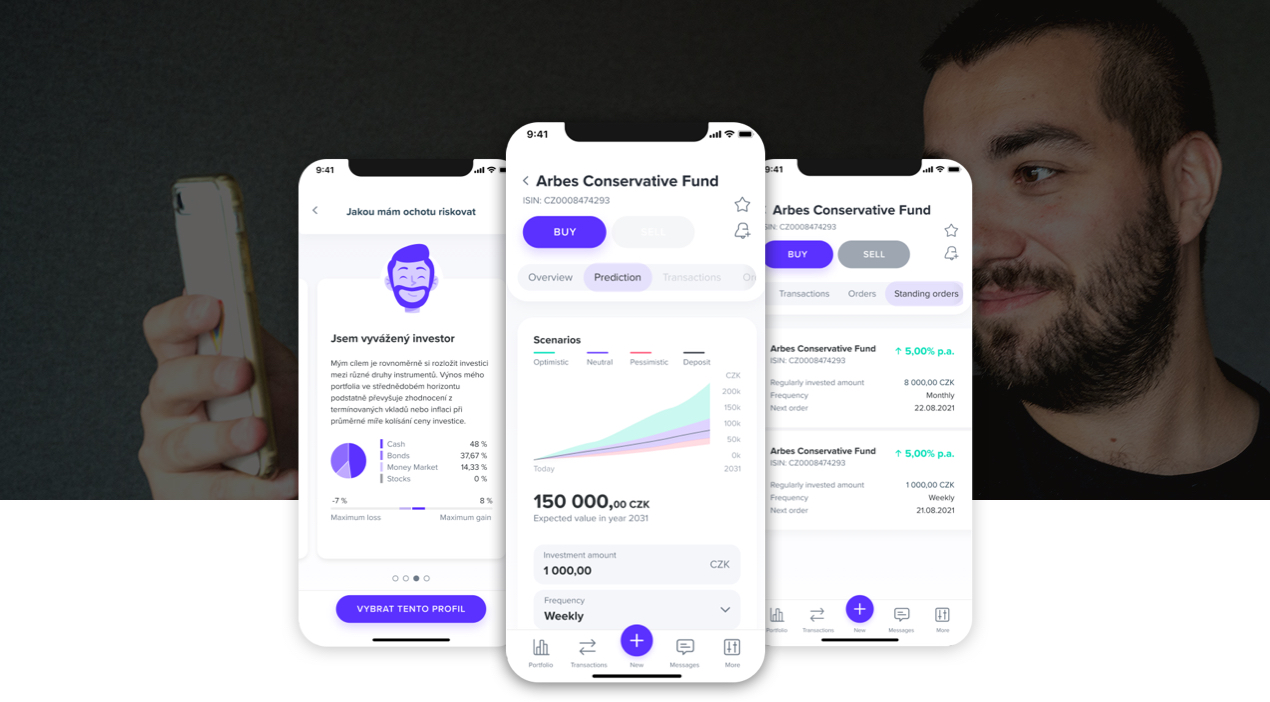

ARBES AIMA

Universal mobile investment app for retail investors

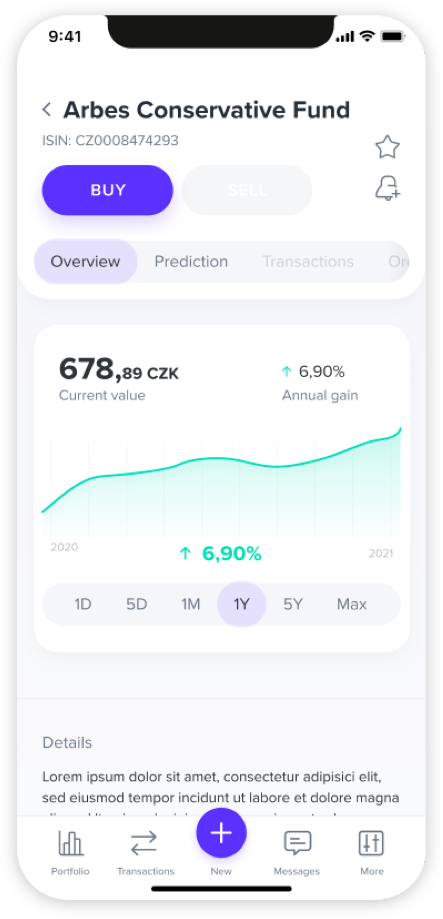

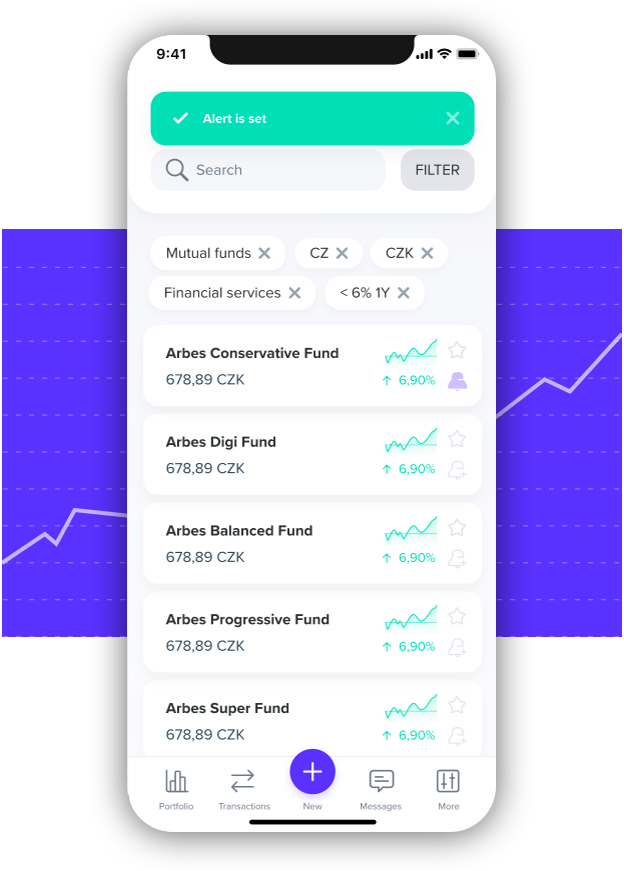

ARBES AIMA represents a comprehensive solution in the field of "mobile native" client service. It is a modular ecosystem providing key elements for client servicing in the field of investments and capital markets. The application is based on a microservices architecture and is designed with a mobile-first approach, ensuring a superior end-to-end client servicing experience in capital markets.

- Ready to deploy

ARBES AIMA is a "ready to deploy" solution, which means it is ready for immediate implementation with minimal development on the client side.

- Flexibility

ARBES AIMA offers a wide range of configurations to reflect as many business needs as possible for clients from banks, investment companies, securities dealers and brokers, as well as the requirements of end clients. The application allows native interfacing with compatible ARBES products such as ARBES AMS, TA or TOPAS, as well as connection via REST API to another customer's core system.

- White label product

ARBES AIMA has its own design and also allows customization of the color scheme, with which the application can be easily "dressed" to its own corporate identity.

- Scalability

From a basic frontend solution to a "Full Mobile Experience". ARBES AIMA allows you to extend the core frontend solution with additional modules such as client onboarding including an investment questionnaire.

- Saves costs

The solution reduces the cost of developing and supporting a custom application by providing off-the-shelf components for common investment operations.

On-boarding

- Application activation

- Client identification

- Investment questionnaire

- Signing contract documents

Dashboard and Overviews

- Positions held

- Settlement accounts

- Instructions

- Transactions

- Regular investments

ARBES AIMA

- Provides a complete digital investment service

- Native mobile version of the app for iOS and Android

- Fully digital onboarding (Onboarding module)

- Dynamic investment questionnaire (MiFID Q module)

- Evaluation of investment instruments according to the client's risk profile (Product Finder module)

- Easy integration with existing core systems

- Quick processing of corporate identity

- Coverage of regulatory requirements

- 2 language versions CZ and EN

- Takes into account local regulatory specifics

Would you like to know more?

Branislav Beneš

Director of Investment Solutions

Would you like more information about the product? Please contact us. We're happy to help.