ARBES AMS

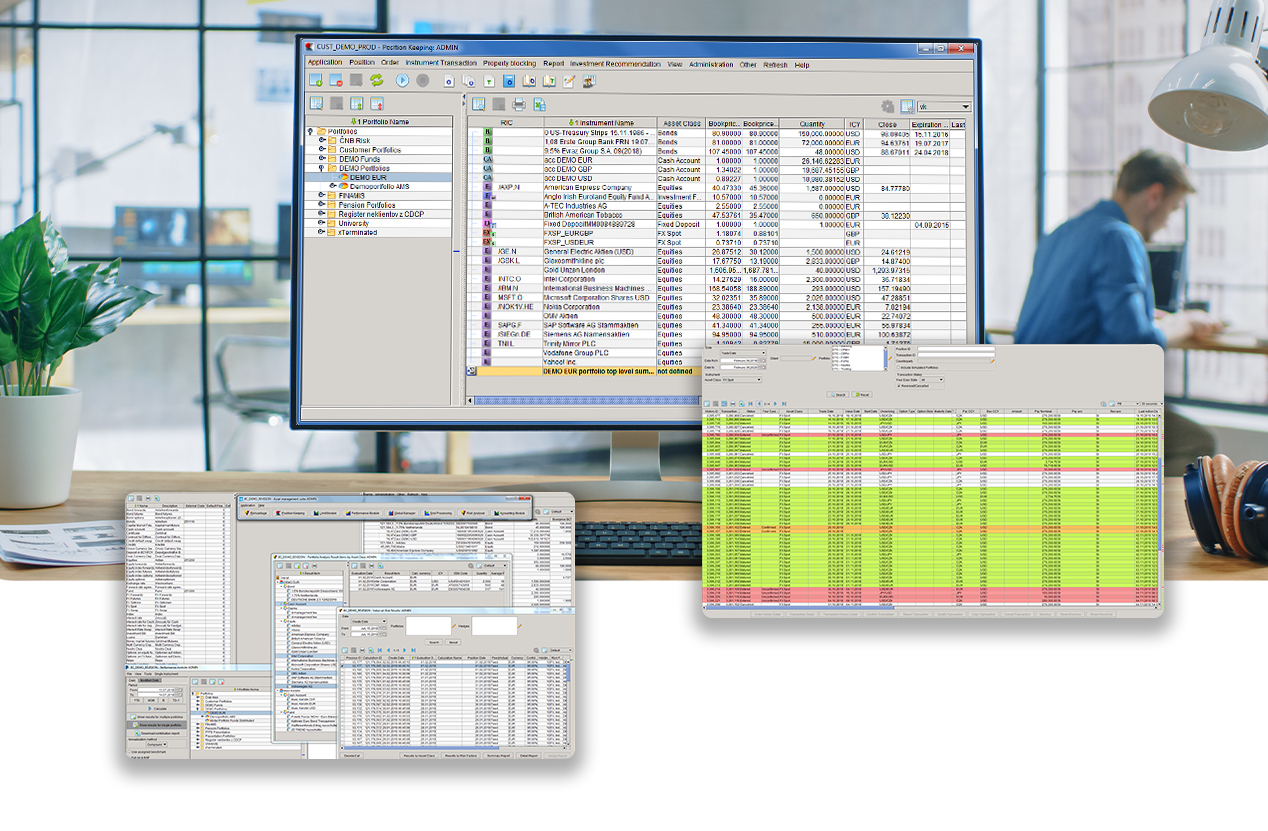

Information system for comprehensive investment portfolio management

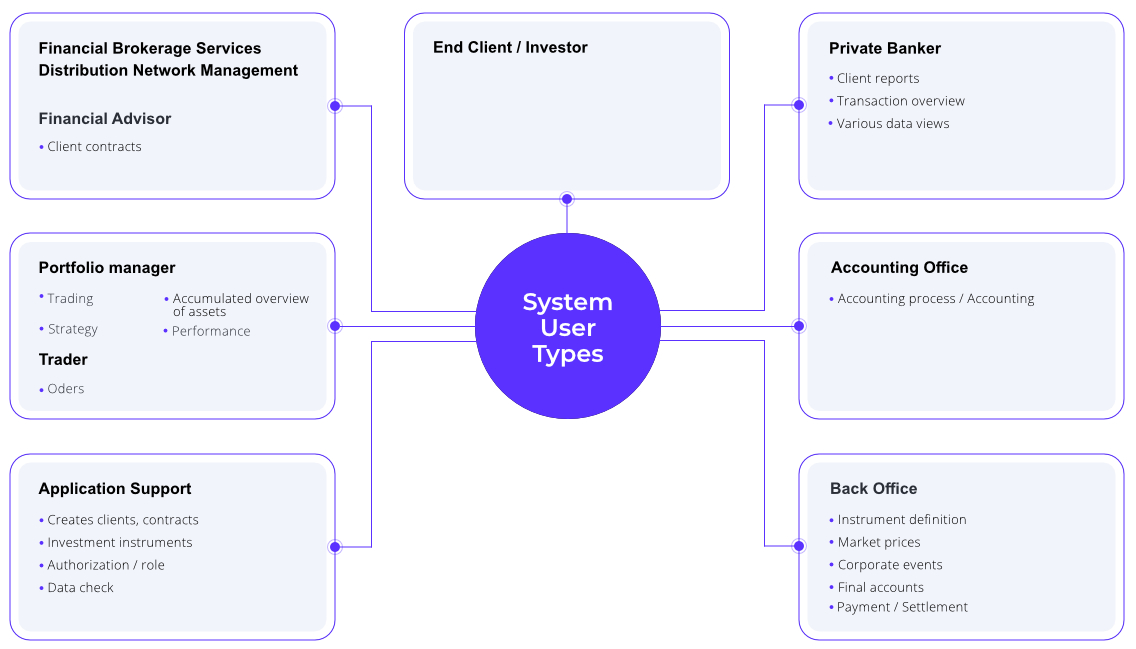

ARBES AMS is a comprehensive software solution that completely covers the asset management needs of investment banking and fund management and represents a new level of support for the capital markets industry. The system provides flexible solution options to meet the needs of companies of diverse business types. It automates asset management processes from the front office to the back office. The core system includes a wide range of functionalities for the work of financial professionals, supports risk analysis, limit control, trading on financial markets, client and legislative reporting solutions, compliance with legislative requirements, securities accounting. At the same time, it enables servicing various customer segments including private banking, treasury and retail clients.

Selected system functionalities

- Client records, asset account records and asset valuation

- Wide coverage of investment products

- Aggregation of multiple client portfolios into composite portfolios

- Performance calculation and attribution analysis

- What-if-scenario a Value-at-risk

- Bulk rebalancing of client portfolios using model portfolios

- Management of multiple pooled entities through central installation

- Monitoring limits (investment, contractual and regulatory)

- Legislation system support – MiFID ll, FATCA, CRS, AML, EMIR, PRIIPs

Product Series

On the frontend, the ARBES AMS core system is complemented by the modern AMS-WEB web layer and a native mobile application designed for end users of investment services.

ARBES AMS modules

Front Office

Front Office

Order Management

- orders

- transactions

Position Keeping

- P/L calculation

- greeks

- near time NAV

Limit Controls

- limits

- ex-post, ex-ante control

Model Portfolios

- automated rebalancing

- robo-advice

Financial Advisory Tool

- MiFID ll conformed advisory preocesses

Fee Illustration Tool

- MiFID ll conformed fee handling

Onboarding Process

- support of BioSign

Middle Office

Middle Office

Risk Management

- value at risk

- what if scenario

Performance Analysis

- asset allocation, performance

- atribution analysis

- riskl of performance

Investment Strategy

- investment strategy

- region, asset type

Back Office

Back Office

Static Data

- customers

- portfolios

- cash accounts

Instrument Data

- instruments

- market data

Fee Management

- success fee

- management fee

- depository fee

- custody fee

End of Day

- pricenf methods

- EOD - NAV

Reporting for supervisor authority

Investment Accounting

Depository Evidence

Transaction and Settlement flow

Taxation

Income Distribution

Client Reports

Global Manager

Global Manager

Setting

Audit

Parametrisation

Processes covered in the system

Downloads

Please enter your email address in the form on the right. We will send you an e-mail with a link to the downloads available for this section.

Would you like to know more?

Branislav Beneš

Director of Investment Solutions

Would you like more information about the product? Please contact us. We're happy to help.