ARBES OBS

ARBES OBS (On-line Banking System) is a universal modern banking system that works in 24*7 mode and covers all the needs of small, medium and large banks.

With its help, banks can serve retail, corporate and private clientele while creating and delivering unique banking products and services in a flexible and unrestricted manner.

OBS is designed for the following

- Banks

- Credit unions

- Loan provider

- Fintech

Areas covered

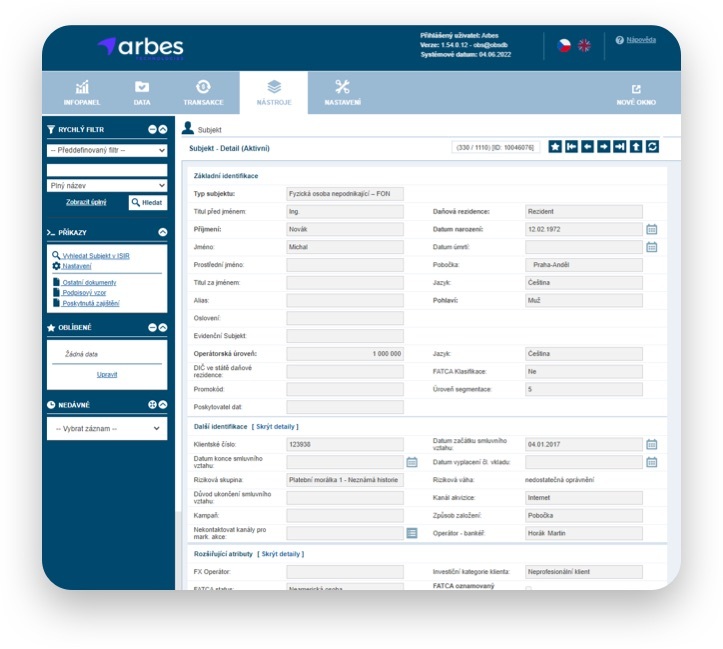

- Client administration

- Loan and deposit product management

- Payment transactions

- Payment cards

Advantages

- A building block model allowing for the implementation of only selected components (modules) that the bank needs to cover its activities

- Speed of implementation – the box solution allows us to implement the bank within 9 months

- Flexibility and wide range of parameterization options

- Automation and digitalization of individual back-office and front-office processes

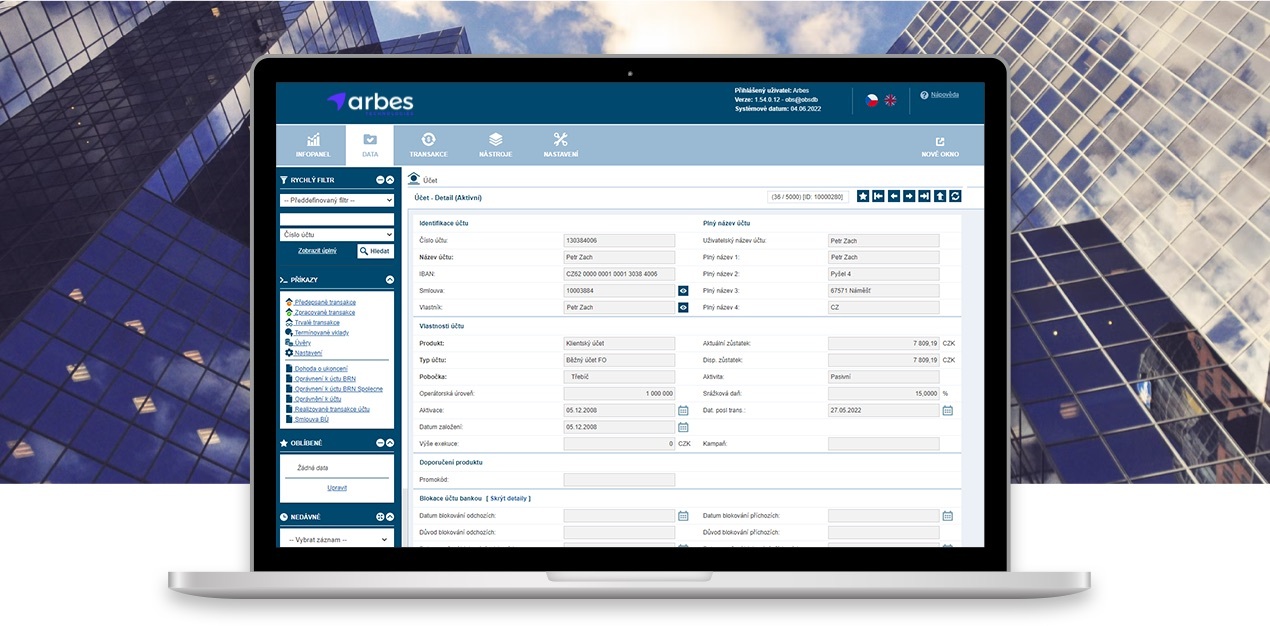

Frontend solution

- Web client (WO) = complete servicing of clients in the branch network and back office via a web client

- Internet banking = servicing your products via internet banking

- Product overview, transactions, statements, requests for new products

Image

Architecture, Deployment & Operations

- Modular product composition

- Open core system (more than 500 APIs exposed for Portals, IB, Mobile App, DMS, DWH, GPE)

- Multi-entity and multi-language system

- Lookup and report management

- Powerful Oracle DB

- Localization in EN and CZ, and others as required

- Automatic upgrade feature

Deployment Options

- Powerful Oracle DB

- Localization in EN and CZ, and others as required

- Automatic upgrade feature

OBS Modules

- Applications/Applicants

- Clients/Subjects (AML, KYC)

- Deposits – current accounts, savings accounts

- Term deposits

- Payment cards

- Loans – consumer/mortgages

- Loans – KTK, revolving

- Collateral

- Bank guarantees

- Transactions (one/off/recurring) SIPO (direct debit of multiple payments), request for direct debit, consent to direct debit

- Payment transactions – domestic, international (SEPA, SWIFT), instant payments in the Czech Republic

- Notifications (email, text message)

- Reporting (dashboards, context, contextless)

References

Downloads

Please enter your email address in the form on the right. We will send you an email with a link to the downloads available for this section.

Files available for download.

OBS_EN.pdf

Would you like to know more?

Petr Červenka

Manager of Banking Solutions

Would you like more information about the product? Please contact us. We're happy to help.

We're hiring in this area

See if we have a banking job opening suitable for you.